Estate Planning Services

We work closely with you to determine what you need for your specific circumstances.

A 15 minute call is all it takes to get started.

Many of us think that any legal process will be impossibly slow, frustrating, costly and impersonal. We assume that’s just how the system works. But what if I told you that it doesn’t have to happen that way for you?

These drawn out, expensive ordeals can be completely avoided by seeking the right support and putting essential tools in place now.

The right legal tools create a support system and a framework for dealing with the unexpected. That way, when the unexpected does occur, you can focus on addressing the more important issue – whether it is injury, illness, disability or worse. You and your loved ones will have a personalized, step-by-step guide to follow without confusion or delay.

How We Can Work Together

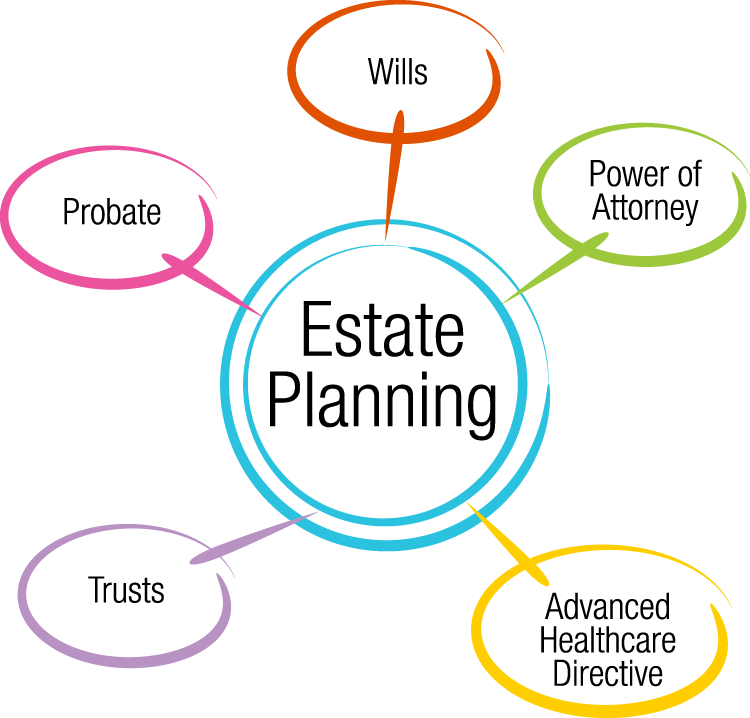

Estate Planning Centerpiece – Trust or Will

Put trusts and wills in place to ensure that the support and legacy for those you leave behind is done. When the time comes, who and what you love will get what you want, at the right time, and in the manner that benefits them the most. A well done plan provides you with incapacity protection and later supports those you leave behind as they weather a very stressful life change. For some, such planning can be transformational.

Supported Decision Making – Financial and health and mental healthcare powers

If you lose control or the ability to manage your affairs due to illness or accident, powers of attorney for financial, medical, mental health measures and living wills ensure a trusted individual is in place to advocate for you and if necessary, make decisions while you are unable to. These tools give trusted people in your life the authority to act for you and in a way that is consistent with your desires.

Essential disability planning. Every adult’s first line of defense to maintain their independence and keep the courts out of the mix, during a period of disability or emergency. For anyone 18 and older. Can stand alone or be part of a comprehensive plan & legal toolkit.

We can put together a plan that ensures your needs and desires will be best served in these situations.

Protection Plans for Children Under Age 18

Ensure the safety, care and well-being of your children by having an emergency plan in place giving legal authority to adults you trust and your children know — if you are delayed or unable to be with your children temporarily.

Special Needs Children and Adults – Trusts, Guardianships and etc.

Establish or update plans to ensure individuals with disabilities are protected— both personally and their inheritance. The right mix of legal support is unique to the individual. Preserving public benefits and conveying inheritance is often a priority, but other concerns may be outlining care plans, identifying lifestyle preferences and detailing precisely how to address public benefits, finances and more.

Trust and Estate Administration

Even the strongest of us deserves legal guidance and support when shouldering the responsibility of administering someone’s affairs at death. The circumstances are tough and the details can be daunting. For some it’s overwhelming. The law is often quite specific in terms of the process to follow to settle a deceased person’s affairs. I can provide support and counsel if you are an administrator — whether to settle affairs and distribute inheritances, or to act as trustee for continuing trusts for inheritors. On the flip-side, beneficiaries can and should understand their legal rights as explained by impartial legal counsel

Adult Guardianship (uncontested)

We provide full support for those who need to establish a court-awarded Guardianship for an adult child with disabilities. Most of our clients are parents of children whose disabilities were present before age 18 and who are now turning 18 or older.

Other Niche Planning

We offer modern, unique, whole-you planning. Purposeful. Proactively exploring select options that, for certain facts and circumstances, you at least should know more about, such as:

IRA/Pension/Retirement Asset

Outright inheritance is not the only way to transfer these valuable safety-net assets to the next generation.

Guns

Federally regulated firearms and paraphernalia often benefit from special handling. “Gun” trusts to make the job of owning and later transferring these collectibles smoother and less costly in the long run.

Estate taxes

Whether the value of assets owned at death are subject to Federal Estate Tax is not the question for most people. But the techniques of splitting trusts for tax reasons has morphed into blended family planning. Is your current plan out of date?

Special assets

Individual gifts of collectibles, real estate, jewelry and other items have a place in your plan. Often times items with high sentimental value are the most treasured and meaningful gift. Common sense does not always ensure their peaceful passage. We can help here, too.

Other

Gifts to charity. Income and capital gains taxes. Business succession planning. Lifetime gifts. Estate tax planning.